33 Learning Bank – Checking & Savings Accounts

People generally use checking accounts to store money in the short term until it is needed for day to day expenses – like gas or groceries – or to pay bills, and they can usually deposit or withdraw any amount of money in their account as many times as they like. Checking accounts also come with convenient ways to deposit and withdraw money from the account, such as checks and ATM cards. However, people with checking accounts must be careful when using them, since some banks charge fees for certain actions, such as using another bank’s ATM, withdrawing more money from your account than the amount in it, or not maintaining a minimum balance.

On the other hand, a savings account is used to set money aside for use in the future and allow the money to collect interest. Many people regularly place some of their money into savings accounts rather than spending it in order to achieve financial goals, such as buying the latest gadget or game, without having to go into debt to do it.

Compound interest is interest paid on both the money you put into your account and the interest already earned. For example, if you put $100 into an account that earns 10% interest, you will initially earn $10, which will result in a total account balance of $110. The next time your account earns 10% it will be based on $110 instead of just $100, giving you a total account balance of $121.

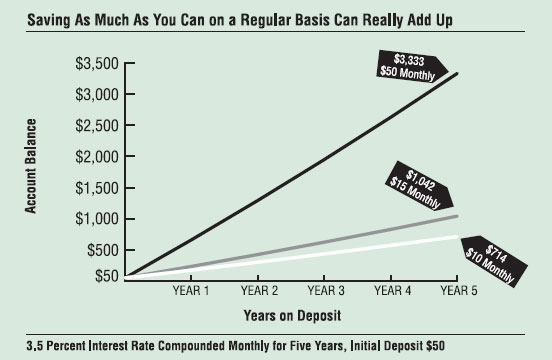

You can earn even more in compound interest if you stretch to put as much money as you can into your account and leave it untouched. See the chart below, which is based on a savings account started with $50 and earning interest at a rate of 3.5% each month. If you add just $10 each month, the account can grow nicely to $714 after five years. If you instead put in a slightly higher amount—$15 each month—you’d have a balance of $1,042 after five years. But if you had increased your deposits to $50 a month, those extra dollars plus the compounding of interest would give you a balance of $3,333 after five years.

There are many banks that offer special accounts for kids and teens, so talk to your parents if you’d like to open an account of your own and start learning how to manage money. But you don’t need a bank account to start the habit of saving – a simple piggy bank will do!