124 Reading: Measuring Total Output

Measuring Total Output

An economy produces a mind-boggling array of goods and services. In 2007, for example, Domino’s Pizza produced 400 million pizzas. The United States Steel Corporation, the nation’s largest steel company, produced 23.6 million tons of steel. Strong Brothers Lumber Co., a Colorado firm, produced 2.1 million board feet of lumber. The Louisiana State University football team drew 722,166 fans to its home games—and won the national championship. Leonor Montenegro, a pediatric nurse in Los Angeles, delivered 387 babies and took care of 233 additional patients. A list of all the goods and services produced in any year would be virtually endless.

So—what kind of year was 2007? We would not get very far trying to wade through a list of all the goods and services produced that year. It is helpful to have instead a single number that measures total output in the economy; that number is GDP.

The Components of GDP

We can divide the goods and services produced during any period into four broad components, based on who buys them. These components of GDP are personal consumption (C), gross private domestic investment (I), government purchases (G), and net exports or exports minus imports (X-M). Thus

GPD = consumption (C) + private investment (I) + government purchases (G) + net exports (X-M)

OR

GPD = C + I + G + (X-M)

Personal Consumption

Personal consumption is a flow variable that measures the value of goods and services purchased by households during a time period. Purchases by households of groceries, health-care services, clothing, and automobiles—all are counted as consumption.

The production of consumer goods and services accounts for about 70% of total output. Because consumption is such a large part of GDP, economists seeking to understand the determinants of GDP must pay special attention to the determinants of consumption. In a later chapter we will explore these determinants and the impact of consumption on economic activity.

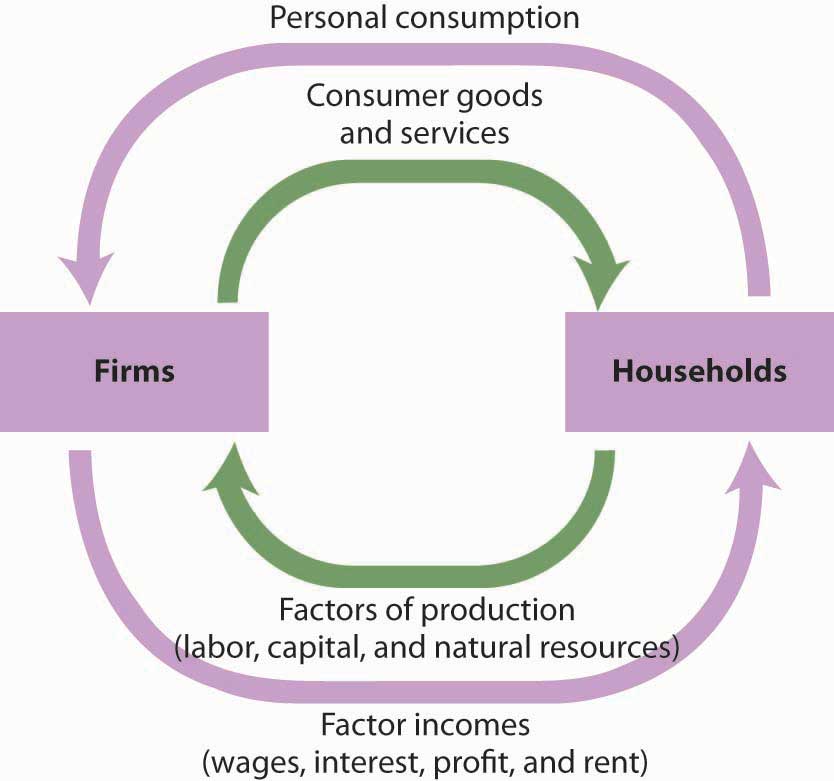

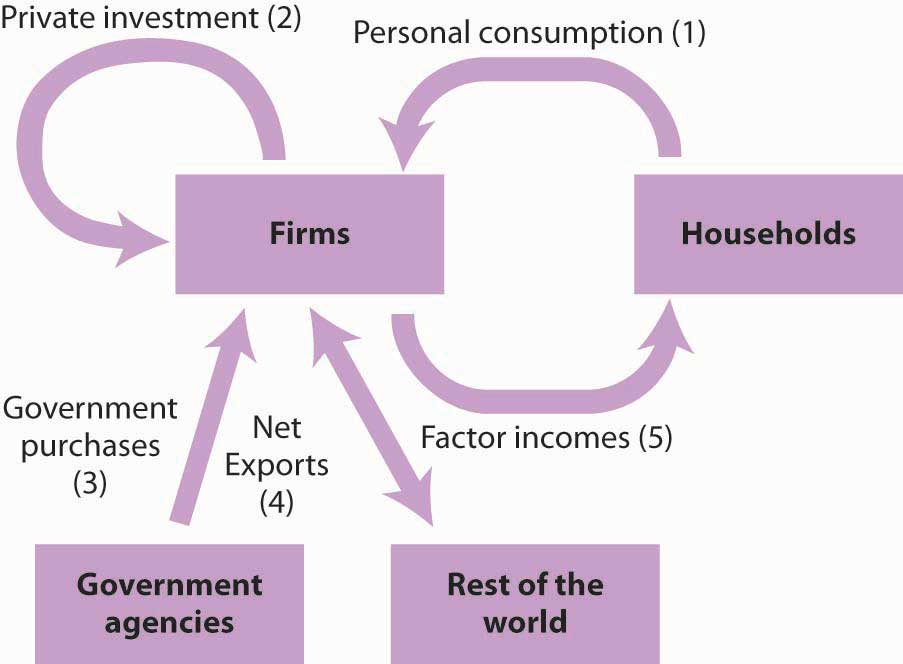

Personal consumption represents a demand for goods and services placed on firms by households. In the chapter on demand and supply, we saw how this demand could be presented in a circular flow model of the economy. Figure 6.1 “Personal Consumption in the Circular Flow” presents a circular flow model for an economy that produces only personal consumption goods and services. (We will add the other components of GDP to the circular flow as we discuss them.) Spending for these goods flows from households to firms; it is the arrow labeled “Personal consumption.” Firms produce these goods and services using factors of production: labor, capital, and natural resources. These factors are ultimately owned by households. The production of goods and services thus generates income to households; we see this income as the flow from firms to households labeled “Factor incomes” in the exhibit.

In exchange for payments that flow from households to firms, there is a flow of consumer goods and services from firms to households. This flow is shown in Figure 6.1 “Personal Consumption in the Circular Flow” as an arrow going from firms to households. When you buy a soda, for example, your payment to the store is part of the flow of personal consumption; the soda is part of the flow of consumer goods and services that goes from the store to a household—yours.

Similarly, the lower arrow in Figure 6.1 “Personal Consumption in the Circular Flow” shows the flow of factors of production—labor, capital, and natural resources—from households to firms. If you work for a firm, your labor is part of this flow. The wages you receive are part of the factor incomes that flow from firms to households.

Because our focus is macroeconomics, the study of aggregates of economic activity, we will think in terms of the total of personal consumption and the total of payments to households in the circular flow.

Private Investment

Gross private domestic investment is the value of all goods produced during a period for use in the production of other goods and services. Like personal consumption, gross private domestic investment is a flow variable. It is often simply referred to as “private investment.” A hammer produced for a carpenter is private investment. A printing press produced for a magazine publisher is private investment, as is a conveyor-belt system produced for a manufacturing firm. Capital includes all the goods that have been produced for use in producing other goods; it is a stock variable. Private investment is a flow variable that adds to the stock of capital during a period.

Heads Up!

The term “investment” can generate confusion. In everyday conversation, we use the term “investment” to refer to uses of money to earn income. We say we have invested in a stock or invested in a bond. Economists, however, restrict “investment” to activities that increase the economy’s stock of capital. The purchase of a share of stock does not add to the capital stock; it is not investment in the economic meaning of the word. We refer to the exchange of financial assets, such as stocks or bonds, as financial investment to distinguish it from the creation of capital that occurs as the result of investment. Only when new capital is produced does investment occur. Confusing the economic concept of private investment with the concept of financial investment can cause misunderstanding of the way in which key components of the economy relate to one another.

Gross private domestic investment includes three flows that add to or maintain the nation’s capital stock: expenditures by business firms on new buildings, plants, tools, equipment, and software that will be used in the production of goods and services; expenditures on new residential housing; and changes in business inventories. Any addition to a firm’s inventories represents an addition to investment; a reduction subtracts from investment. For example, if a clothing store stocks 1,000 pairs of jeans, the jeans represent an addition to inventory and are part of gross private domestic investment. As the jeans are sold, they are subtracted from inventory and thus subtracted from investment.

By recording additions to inventories as investment and reductions from inventories as subtractions from investment, the accounting for GDP records production in the period in which it occurs. Suppose, for example, that Levi Strauss manufactures 1 million pairs of jeans late in 2007 and distributes them to stores at the end of December. The jeans will be added to inventory; they thus count as investment in 2007 and enter GDP for that year. Suppose they are sold in January 2008. They will be counted as consumption in GDP for 2008 but subtracted from inventory, and from investment. Thus, the production of the jeans will add to GDP in 2007, when they were produced. They will not count in 2008, save for any increase in the value of the jeans resulting from the services provided by the retail stores that sold them.

Private investment accounts for about 16% of GDP. Despite its relatively small share of total economic activity, private investment plays a crucial role in the macroeconomy for two reasons:

- Private investment represents a choice to forgo current consumption in order to add to the capital stock of the economy. Private investment therefore adds to the economy’s capacity to produce and shifts its production possibilities curve outward. Investment is thus one determinant of economic growth, which is explored in another chapter.

- Private investment is a relatively volatile component of GDP; it can change dramatically from one year to the next. Fluctuations in GDP are often driven by fluctuations in private investment. We will examine the determinants of private investment in a chapter devoted to the study of investment.

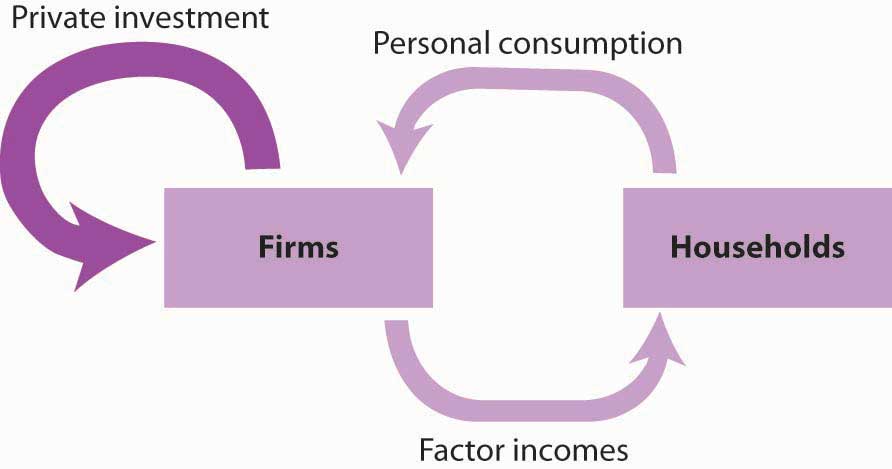

Private investment represents a demand placed on firms for the production of capital goods. While it is a demand placed on firms, it flows from firms. In the circular flow model in Figure 6.2 “Private Investment in the Circular Flow,” we see a flow of investment going from firms to firms. The production of goods and services for consumption generates factor incomes to households; the production of capital goods for investment generates income to households as well.

Figure 6.2 “Private Investment in the Circular Flow” shows only spending flows and omits the physical flows represented by the arrows in Figure 6.1 “Personal Consumption in the Circular Flow.” This simplification will make our analysis of the circular flow model easier. It will also focus our attention on spending flows, which are the flows we will be studying.

Government Purchases

Government agencies at all levels purchase goods and services from firms. They purchase office equipment, vehicles, buildings, janitorial services, and so on. Many government agencies also produce goods and services. Police departments produce police protection. Public schools produce education. The National Aeronautics and Space Administration (NASA) produces space exploration.

Government purchases are the sum of purchases of goods and services from firms by government agencies plus the total value of output produced by government agencies themselves during a time period. Government purchases make up about 20% of GDP.

Government purchases are not the same thing as government spending. Much government spending takes the form of transfer payments, which are payments that do not require the recipient to produce a good or service in order to receive them. Transfer payments include Social Security and other types of assistance to retired people, welfare payments to poor people, and unemployment compensation to people who have lost their jobs. Transfer payments are certainly significant—they account for roughly half of all federal government spending in the United States. They do not count in a nation’s GDP, because they do not reflect the production of a good or service.

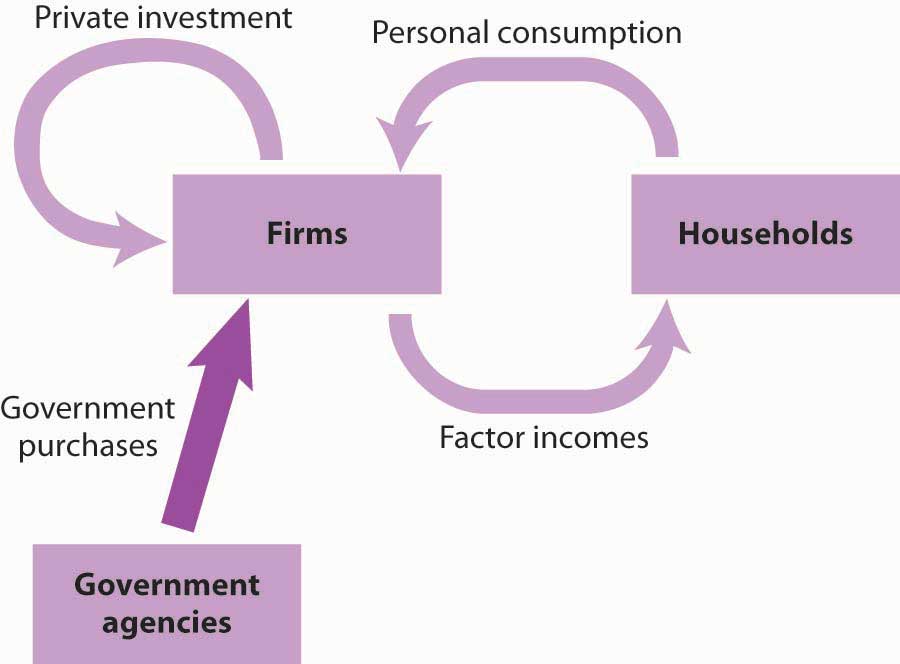

Government purchases represent a demand placed on firms, represented by the flow shown in Figure 6.3 “Government Purchases in the Circular Flow.” Like all the components of GDP, the production of goods and services for government agencies creates factor incomes for households.

Net Exports

Sales of a country’s goods and services to buyers in the rest of the world during a particular time period represent its exports. A purchase by a Japanese buyer of a Ford Taurus produced in the United States is a U.S. export. Exports also include such transactions as the purchase of accounting services from a New York accounting firm by a shipping line based in Hong Kong or the purchase of a ticket to Disney World by a tourist from Argentina. Imports are purchases of foreign-produced goods and services by a country’s residents during a period. United States imports include such transactions as the purchase by Americans of cars produced in Japan or tomatoes grown in Mexico or a stay in a French hotel by a tourist from the United States. Subtracting imports from exports yields net exports.

Exports (X) – imports (M) = net exports (X-M)

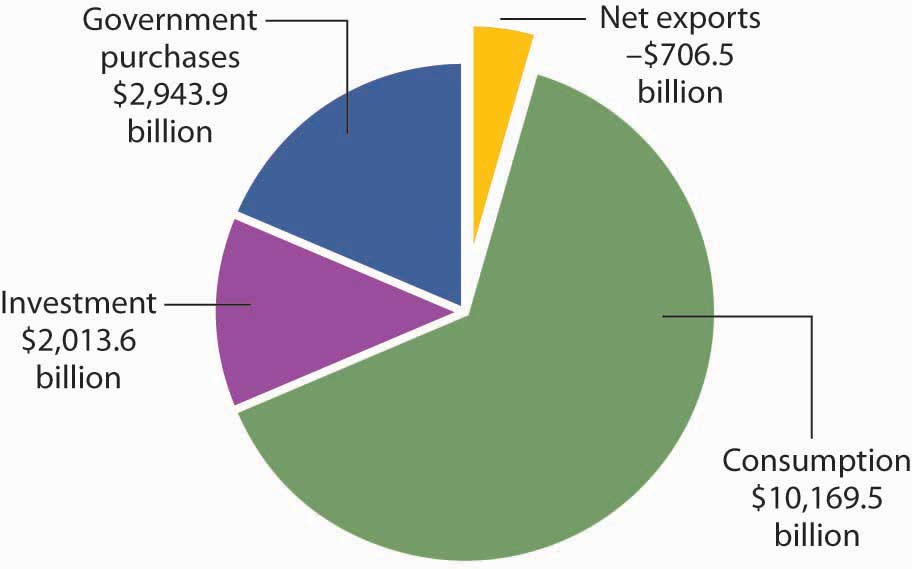

In the third quarter of 2008, foreign buyers purchased $1,971.3 billion worth of goods and services from the United States. In the same year, U.S. residents, firms, and government agencies purchased $2,677.9 billion worth of goods and services from foreign countries. The difference between these two figures, −$706.6 billion, represented the net exports of the U.S. economy in the third quarter of 2008. Net exports were negative because imports exceeded exports. Negative net exports constitute a trade deficit. The amount of the deficit is the amount by which imports exceed exports. When exports exceed imports there is a trade surplus. The magnitude of the surplus is the amount by which exports exceed imports.

The United States has recorded more deficits than surpluses since World War II, but the amounts have typically been relatively small, only a few billion dollars. The trade deficit began to soar, however, in the 1980s and again in the 2000s. We will examine the reasons for persistent trade deficits in another chapter. The rest of the world plays a key role in the domestic economy and, as we will see later in the book, there is nothing particularly good or bad about trade surpluses or deficits. Goods and services produced for export represent roughly 14% of GDP, and the goods and services the United States imports add significantly to our standard of living.

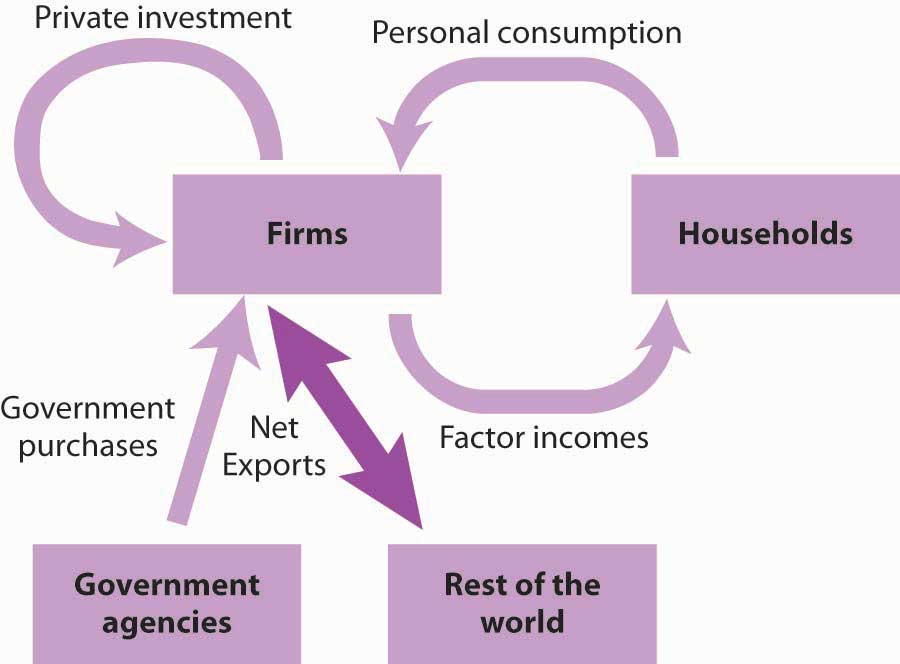

In the circular flow diagram in Figure 6.4 “Net Exports in the Circular Flow,” net exports are shown with an arrow connecting firms to the rest of the world. The balance between the flows of exports and imports is net exports. When there is a trade surplus, net exports are positive and add spending to the circular flow. A trade deficit implies negative net exports; spending flows from firms to the rest of the world.

The production of goods and services for personal consumption, private investment, government purchases, and net exports makes up a nation’s GDP. Firms produce these goods and services in response to demands from households (personal consumption), from other firms (private investment), from government agencies (government purchases), and from the rest of the world (net exports). All of this production creates factor income for households. Figure 6.5 “Spending in the Circular Flow Model” shows the circular flow model for all the spending flows we have discussed. Each flow is numbered for use in the exercise at the end of this section.

The circular flow model identifies some of the forces at work in the economy, forces that we will be studying in later chapters. For example, an increase in any of the flows that place demands on firms (personal consumption, private investment, government purchases, and exports) will induce firms to expand their production. This effect is characteristic of the expansion phase of the business cycle. An increase in production will require firms to employ more factors of production, which will create more income for households. Households are likely to respond with more consumption, which will induce still more production, more income, and still more consumption. Similarly, a reduction in any of the demands placed on firms will lead to a reduction in output, a reduction in firms’ use of factors of production, a reduction in household incomes, a reduction in income, and so on. This sequence of events is characteristic of the contraction phase of the business cycle. Much of our work in macroeconomics will involve an analysis of the forces that prompt such changes in demand and an examination of the economy’s response to them.

Figure 6.6 “Components of GDP, 2008 (Q3) in Billions of Dollars” shows the size of the components of GDP in 2008. We see that the production of goods and services for personal consumption accounted for about 70% of GDP. Imports exceeded exports, so net exports were negative.

Final Goods and Value Added

GDP is the total value of all final goods and services produced during a particular period valued at prices in that period. That is not the same as the total value of all goods and services produced during a period. This distinction gives us another method of estimating GDP in terms of output.

Suppose, for example, that a logger cuts some trees and sells the logs to a sawmill. The mill makes lumber and sells it to a construction firm, which builds a house. The market price for the lumber includes the value of the logs; the price of the house includes the value of the lumber. If we try to estimate GDP by adding the value of the logs, the lumber, and the house, we would be counting the lumber twice and the logs three times. This problem is called “double counting,” and the economists who compute GDP seek to avoid it.

In the case of logs used for lumber and lumber produced for a house, GDP would include the value of the house. The lumber and the logs would not be counted as additional production because they are intermediate goods that were produced for use in building the house.

Another approach to estimating the value of final production is to estimate for each stage of production the value added, the amount by which the value of a firm’s output exceeds the value of the goods and services the firm purchases from other firms. Table 6.1 “Final Value and Value Added” illustrates the use of value added in the production of a house.

| Table 6.1. Final Value and Value Added | ||||

|---|---|---|---|---|

| Good | Produced by | Purchased by | Price | Value Added |

| Logs | Logger | Sawmill | $12,000 | $12,000 |

| Lumber | Sawmill | Construction firm | $25,000 | $13,000 |

| House | Construction firm | Household | $125,000 | $100,000 |

| Final Value | $125,000 | |||

| Sum of Values Added | $125,000 | |||

If we sum the value added at each stage of the production of a good or service, we get the final value of the item. The example shown here involves the construction of a house, which is produced from lumber that is, in turn, produced from logs.

Suppose the logs produced by the logger are sold for $12,000 to a mill, and that the mill sells the lumber it produces from these logs for $25,000 to a construction firm. The construction firm uses the lumber to build a house, which it sells to a household for $125,000. (To simplify the example, we will ignore inputs other than lumber that are used to build the house.) The value of the final product, the house, is $125,000. The value added at each stage of production is estimated as follows:

- The logger adds $12,000 by cutting the logs.

- The mill adds $13,000 ($25,000 − $12,000) by cutting the logs into lumber.

- The construction firm adds $100,000 ($125,000 − $25,000) by using the lumber to build a house.

The sum of values added at each stage ($12,000 + $13,000 + $100,000) equals the final value of the house, $125,000.

The value of an economy’s output in any period can thus be estimated in either of two ways. The values of final goods and services produced can be added directly, or the values added at each stage in the production process can be added. The Commerce Department uses both approaches in its estimate of the nation’s GDP.

Self Check: Calculating GDP

Answer the question(s) below to see how well you understand the topics covered in the previous section. This short quiz does not count toward your grade in the class, and you can retake it an unlimited number of times.

You’ll have more success on the Self Check if you’ve completed the two Readings in this section.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.